Points of view | Insights

The automotive industry and MaaS in FranceTransform to better meet consumer expectations and take advantage of the mobility of tomorrow.

The new vehicle market: a challenge for carmakers

In 2017, 48% of new vehicles were sold to individuals, 22% to businesses, 18% to dealers and 12% to rental companies. Direct sales to dealers or short-term leasers are much less profitable. However, the proportion of sales to individuals and companies is declining each year: 77% in 2010, 72% in 2015 and 70% in 2017. Customers who used to buy new are now looking for recent second-hand cars. Direct sales and sales to rental companies are a second step in satisfying this demand.

New car sales (excluding LCVs) rose by 1.88% between 2018 and 2019 in France, according to the CCFA, with a total of more than 2.2 million new cars sold. Overall, corporate vehicle purchases were the main driver in 2019. In fact, new vehicle sales to individuals declined by 7% between 2018 and 2019(1). This is mainly a consequence of natural market trends:

- the household car ownership rate (83% in 2017) is close to its maximum: new vehicle sales are based on the renewal of the vehicle fleet.

- the average time of vehicle ownership has increased from 3.7 years in 1990 to 5.6 years in 2017: the fleet renewal rate is slower.

Faced with this market decline and the emergence of new competitors, manufacturers must propose complementary offers and diversify.

In addition to passenger cars, automakers are tackling a booming mobility market.

New forms of mobility are gaining ground

New forms of mobility are growing and pose a challenge to carmakers, who must deal with new competitors and (re)position themselves as mobility players in the broadest sense.

Indeed, even if 6 out of 10 urbans (conurbations with more than 20,000 inhabitants) still declare themselves dependent of their personal vehicle, they are more willing to give up their personal vehicle if they have a higher use of shared vehicle solutions(2).

In this respect, car-sharing, public transport and self-service solutions are gaining popularity. The success of BlaBlaCar, a long-distance car-sharing service(8) is undeniable (+71% in sales, +17M new members in 2019). In 2016, public transportation remained dominated by cabs, which accounted for 78% of the offer. The share of VTC increased significantly, from 22% in 2016 to 42% in 2018(4).

At the same time, sales of PEPME (Personal Electric Powered Mobility Equipment), particularly electric scooters, have been growing at a rapid pace(3). Until June 2018, self-service electric scooter systems did not exist!

On the other hand, the number of self-service bicycle systems has almost doubled in ten years, from 32 to 57(5). The multiplication of these systems reflects growing demand: trips using the Vélib‘ Métropole doubled in between 2019 and 2020(6), despite confinement measures.

New forms of mobility therefore seem to have won over many French people.

Cities are changing and MaaS tools are being developed to meet the need of urbans

Mobility as a Service (MaaS) is a multimodal urban mobility concept that puts mobility at the service of users. With the multiplication of mobility offers, the need for MaaS tools aggregating all the offers – traffic information, trip planning and payment – becomes more important. The most advanced tools enable users to choose, book and pay for their multimodal trips in a single step at the end of the month. The most accurate ones will allow you to optimize the itinerary according to network usage, traffic or possible breakdowns.

Many French cities are taking the plunge, such as Saint-Etienne with Moovizy 2, conjointly developed by Transdev and the city(9), Paris with the MaaX pilot supported by the m2i project to which Renault and PSA(10) are contributing, Dijon with the Divia, Annemasse with the RATP(11) and others.

The possibilities offered by MaaS embody the idea that freedom will no longer reside in possessing a vehicle, but in the ability to choose the most advantageous and practical mode of transportation for a given trip.

Beyond MaaS, cities are seeking to transform themselves to reshape urban mobility. Numerous projects are underway or under study:

- Urban cable cars in Brest, Medellin, New York and London, for example

- Flying cab with Airbus, Volocopter, Uber/Hyundai

- Cab robot/autonomous vehicles with Navya, the first cab robot tested in France, Renault, Google…

- Robotic parking with Stanley Robotics tested at Lyon airport

Focus ON Moovizy 2

The only service today in France that allows users to consult, choose, book and pay for trips with a single application.

5 modes of transportation: public transportation, self-service bicycles (Vélivert), car-sharing (Citiz), carpooling (Mov’ici), cabs, etc.

25,000 users

Launched in 2019 to replace Moovizy (2016)

New players are taking root in the mobility panorama

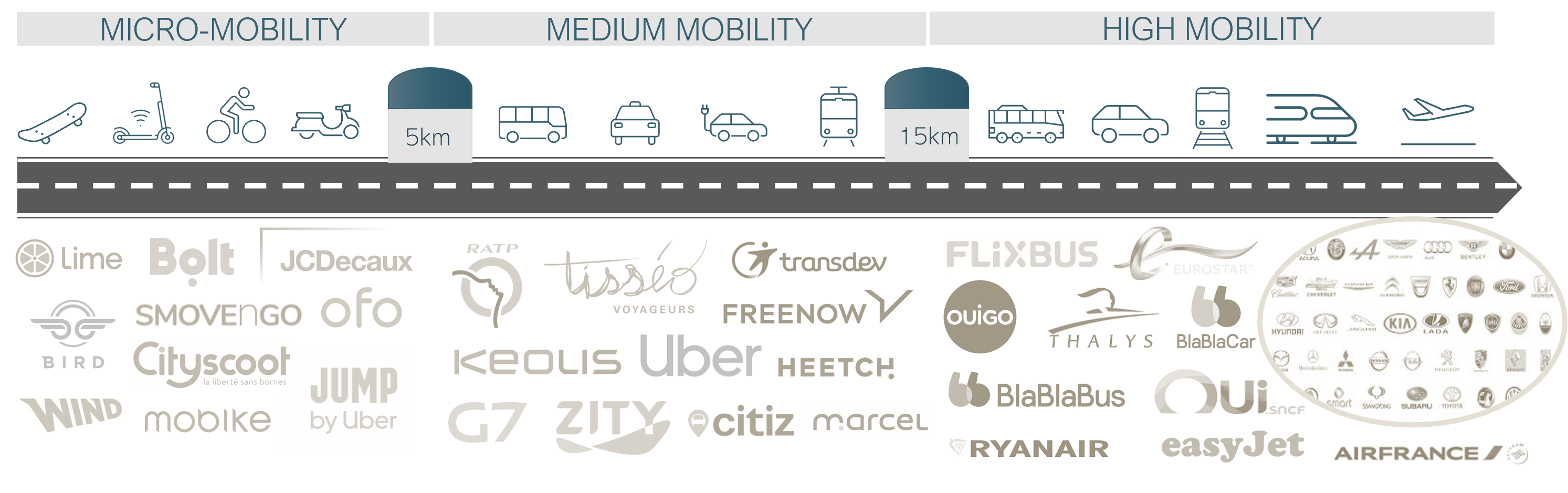

Micro-mobility, long dominated by self-service bicycles, has seen the arrival of new free-floating players: scooters, bicycles, scooters, all driven by innovation in electric mobility.

Medium mobility has been disrupted by VTC’s, and particularly Uber, which is attacking historic cabs with a new business model. Car-sharing vehicles are also expected to grow 20% per annum until 2025(12).

In addition to the carpooling boom, high mobility has also evolved. For example, the air, rail and road passenger transport sectors have expanded with low-cost offers

The mobility offer has diversified at lightning speed in recent years. It is safe to say that tomorrow’s models will amplify today’s trends: cleaner, shared, multimodal, intelligent and more personalized.

.

The role of carmakers in these new forms of mobility is challenged

As the profitability of traditional carmakers declines and new entrants enter the mobility market, the time has come for carmakers to rethink their business model to drive profitability. 5 business models seem appropriate:

-

TRADITIONAL CAR MAKER – HIGH-END SEGMENT:

To maintain margins and profitability in the long term, manufacturers can focus on premium or even luxury segments. This market, although small in size, offers significant potential for profitability. The share of premium in total registrations (12%) is still low in France, much lower than in Germany or the United Kingdom.

-

B2B CARMAKERS – SUPPLIER OF RENTAL | SHARE CAR FLEETS:

As car-sharing market and rental models develop, the role of manufacturers may focus on providing more vehicles for mobility services.

-

FLEET OPERATORS:

In a model driven by rental vehicles, car sharing, manufacturers have a card to play by integrating the downstream end of the value chain, i.e. fleet management. Their knowledge and experience of customer mobility needs will represent a competitive advantage in this area.

-

AUTOMOTIVE MOBILITY SERVICE PROVIDER:

By relying on a more service-oriented approach, manufacturers can offer car-related mobility services (car-sharing, carpooling, VTC, etc.).

-

END-TO-END MOBILITY SERVICE PROVIDER – MOBILITY-AS-A-SERVICE:

Beyond car production, manufacturers can position themselves as mobility service providers, with a single mobility platform integrating multiple means of transportation and services from the point of departure to the last mile, from short-term car rental to parking reservations.

From carmaket to mobility provider: a sinuous path

More and more manufacturers are now looking to position themselves as mobility service providers, offering various solutions such as flexible rental or VTC services: ultra-competitive activities where margins ultimately remain very low. Among their competitors, manufacturers also find themselves up against public transport operators, with whom they have sometimes chosen to cooperate.

Public transportation operators no longer have the capacity to develop mobility solutions that cover all user needs – as evidenced by the proliferation of micro-mobility and VTC solutions. In this context, keeping pace with pure players means rethinking the balance of power between mobility operators and paving the way for enhanced collaboration, enabling them to take advantage of opportunities and data offered by digital technology. Manufacturers could thus play the role of mobility service providers.

Here are some key success factors:

Scale: mobility platforms leverage key assets to define a scale of operations and a differentiating value proposition.

Revisiting the value chain: new players, both pure players as well as manufacturers or traditional players from other sectors are detecting new opportunities in the mobility sector and seem to want to converge towards a model aggregating mobility solutions. Although the boundaries between core businesses are blurring, the historical know-hows of an automotive manufacturer remains far from those of emerging mobility players, but remain a capitalizable strength: new uses such as connected services, data and sensor use; new business such as electric, autonomous, connected vehicles, etc.

Taking the ecosystem into account: the lack of integration between different modes of transport, private and public, is the major obstacle facing users. This generates friction for users, low level of service and/or adoption, which in turn creates opportunities for new entrants. As a result, the value chain once controlled by incumbent operators is now overburdened by multiple players.

The (re)positioning of carmakers as mobility providers will therefore remain a challenge to be pursued over the long term.

Moving further afield: tomorrow’s mobility…

WHAT COEXISTENCE?

Many different players will drive tomorrow’s mobility, which will tend to be electric, autonomous and shared.

The proliferation and multiplicity of mobility solutions nevertheless raises the question of their coexistence with specific solutions used by different transportation operators. Will all carriers agree to share their data with operators? What associations with existing ticketing? What is the future for conventional public buses with drivers that are inflexible on routes and schedules when other shared solutions allow them to go to the desired point at a specific time? What role for the public network which will compete agaisnt shared autonomous cars? What role for manufacturers when vehicle ownership will no longer be a priority for urbans? So many questions that will have to be answered in the coming years…

While the role of driver’ “technician” will fade, the moderator aspect remains essential. Mobility cannot be dehumanized: the need for regulation, animation and assistance remains necessary for these solutions to work properly.

WHAT RISKS?

New forms of mobility, such as the autonomous car, car-sharing and self-service micro-mobility are leading to a rethinking of the driver’s role. In the case of an autonomous vehicle in particular, the responsibility is no longer borne by the driver, but by the software manufacturer. The probability of having an accident is lower in a car driven by an operating system. Part of the car fleet would reduce risks, and most at-fault accidents would be caused by drivers. The drivers’ insurance premium, carrying this loss rate, would increase. Will it then still be profitable to drive? For insurance companies whose business model is based on accident risks, change is therefore to be expected.

So, in the broadest sense, the issue of transportation safety is shared by all stakeholders, especially industrials and carmakers. This safety issue is seen as central to R&D strategies for autonomous vehicles, as well as to the communication of these technologies, the use of data, etc. Consequently, ethical issues directly concern these security issues.

WHAT SCALE?

While mobility solutions are generally tested on a city scale, wouldn’t the most successful form of mobility as a service (MaaS) involve deploying it on a larger scale, nationally or even internationally? Indeed, projects are under way on a larger scale, and a European alliance has been created with the aim of building a common European approach. The main objective is to facilitate a single, open market and full deployment of MaaS services.

Defining a legal framework is necessary: regulation of new mobility players, coordination of transportation supply, management of users’ private data, etc. At the European level, Regulation 2017/1926 of May 31, 2017 sets the establishment of a national access point for mobility data.

WHAT ENVIRONMENTAL IMPACT?

Intelligent traffic management will encourage road users to use the best means of transport and routes. In addition to facilitating and improving the traveler’s experience, it is also beneficial for the environment since congestion, which is synonymous with pollution, can be reduced with better traffic management.

Although micro-mobility solutions are multiplying and are less polluting to use, the production and charging of new micro-mobility solutions are subject to debate because of the generated pollution.

Also, if a car remains immobilized more than 97% of the time, car sharing does not necessarily imply a reduction in traffic. While some people will abandon their cars in favor of shared solutions, others, who do not own a car, could multiply their trips because of the ease of access to various routes. These effects need to be closely monitored and analyzed.

WHAT SOCIAL IMPACT?

The risk of social and digital exclusion must be taken into account.

Mobility solutions will be digital. However, not everyone necessarily has a smartphone or access to mobile data. This can lead to the social isolation of certain groups of citizens who would no longer be able to travel and have a polarizing effect between those who are connected and those who are less connected.

Also, the geographical coverage and prioritization of access to these solutions would lead to territorial disparities. Will the rural environment be a robot-mobile desert like the white zones for mobile telephony and the Internet today?

What non-digital and/or adapted alternatives according to territories will be addressed to cover all the population’s needs?

Pagamon is a strategy and transformation consulting firm founded in 2013. We support major players in the industry, services and life sciences sectors in their search for balance. Helping them structure their strategic vision, transform their operational and/or digital model, and drive change. To support profitable, sustainable and responsible growth. As a committed player, Pagamon leads the Observatory of the Balanced Organization™, articulated around a “think tank” and an annual survey. In order to provide an innovative, sometimes offbeat, perspective on the strategic support of transformations to support the growth of companies.