Points of view | Insights

AFTER-SALES MARKET: FIND NEW SOURCES OF GROWTH BASED ON A DIFFERENTIATED AND ACCESSIBLE OFFERINGAfter the warranty period, the majority of drivers are no longer going to manufacturer service points to perform vehicle maintenance: manufacturers find that the penetration of their after-sales network on their own fleet – 60% average – falls below 50% for vehicles over 6 years.

In this context, how to boost sales of spare parts? How to win these little captive since very price sensitive customers? At a time when manufacturer review is strongly contested by automotive service providers – such as Speedy, Midas or Feuvert in France – repositioning the after-sales service offer is a necessity. The challenge is to provide each market with a differentiated offering structured around a range of products more adapted to the needs and habits of consumers. This alternative to “original parts” offer addresses a specific customer need: maintain the vehicle when its residual value subsequently decreases. The real differentiation is created by a 20% lower price positioning than the original part.

|

Standard features of range of spare parts for “older vehicles”:

|

What ambition?

According to the area and their marketing anteriority, alternate families of parts declare different penetration rate. Besides, on the international stage, only certain families of parts are given an alternate offer since a few years.

The ambition is then double:

- Increase the turnover of alternate offers already present on the international stage.

- Develop and launch new alternate offers in marketing areas with great potential ofgrowth.

Two strategies are possible according to concerned areas and families:

- Strategy of consolidation (or of defence): it is a question of concentrating on the priority “fleet × family of parts” target-segments, to refocus the product offer and to improve the customer satisfaction by focusing the sales forces on the main markets, that is the flagship products. By concentrating on great potential markets, risks are

minimized, turnover increases and customer satisfaction improves since flagship products are proposed. The purpose is here to have a rather complete product range in key-markets. This strategy is particularly adapted to strong density network areas. - Strategy of attack: it is a question of positioning also on the other manufacturer models with a marketable range by the independent repairers. This strategy is applicable only in big maturity countries where the strategy of defence and customer satisfaction already displays good results.

In any case, to take logistic stresses into account (retail chain and sales force), it is necessary to favour the countries the distribution network of which is dense (high number of wholesalers and 1st rank customers).

In practice…

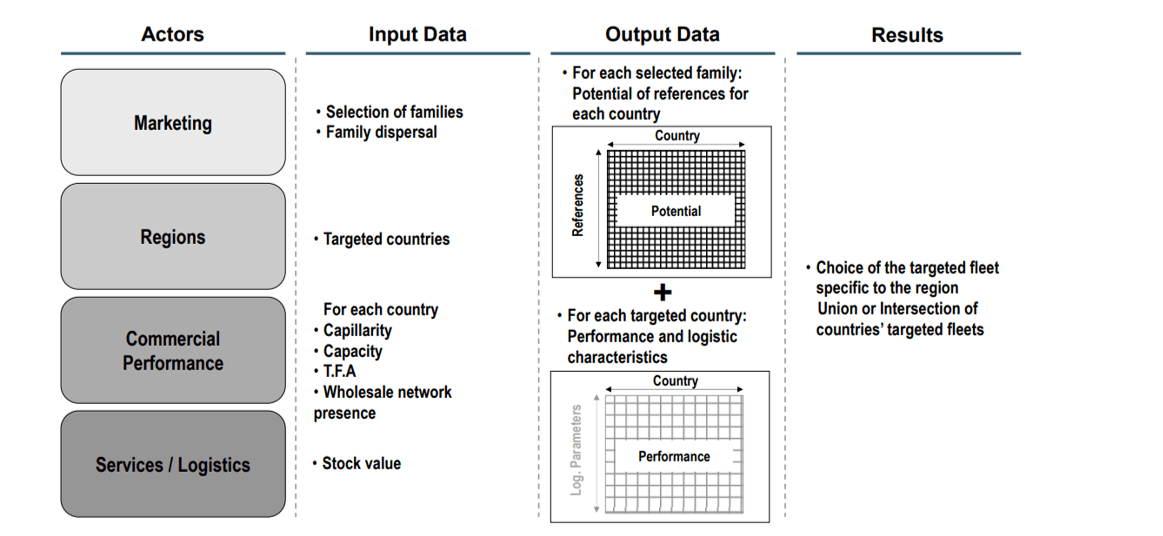

The “extension to new families” ; “extension to new target-fleets” coupling can lead to an iterative reasoning complex to comprehend. The practice shows that the good bias is to begin with the definition of possible extensions in terms of families before to examine the possible extensions in terms of target-fleets. Such a practical approach is synthesized in the following diagram:

Spread the alternate offers to new families

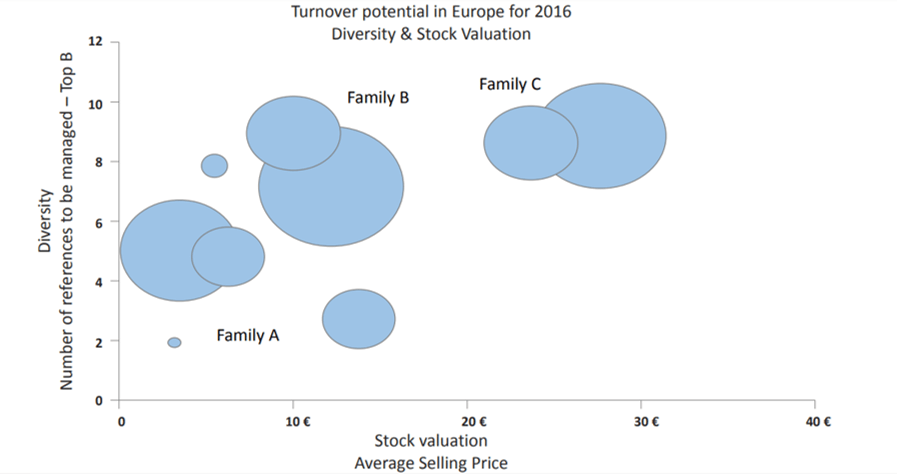

To extend the alternate offers to new families of parts, the priority given to every family is a function of the additional turnover potential and the associated logistic stresses:

- Estimation of the family turnover potential, according to the size of the fleet (any areas), to the rate of family parts replacement, to the market share of the alternate offer, to the average price of the alternate parts, etc.

- Logistic macro-impact of the family, which can be comprehended by the product diversity (number of different references to be managed and stored) and by the value of the stock (in purchasing price).

Spread the alternate offers to new fleets

In a given area, the attractiveness of a target-fleet is a function of considered area specificities and of products to be launched. The selection of families and references has to take into account:

- the target-fleet in the area,

- the presence of the competition,

- the characteristics of the retail chain: capillarity, storage capacity, customer attendance rate…

- the potential logistic impacts of the offer launch.

A prerequisite: the effective spreading of the product technical information

To convince the local actors (internal customers, retailers) of an alternate spare parts offer potential, it is essential to improve the provision of technical information necessary for maintenance and repair, ensuring that the product information is available, complete and unique at the chain end, regardless of the area and the type of retailer.

Held by the manufacturers, this technical information indeed plays a more and more mattering role in the repair of vehicles. The repairer has to be capable of identifying the references of parts necessary for the achievement of every operation, the electrical diagrams, even the process time. This identification is more and more complex because of the increasing number of parts in vehicles and the increasing role of the embedded electronic systems which require the use of diagnostic tools. The process of technical information spreading is itself complex. It implies various actors (manufacturer, data aggregators) as well as multiple information and communication systems. A fluid and effective spreading of the technical information is the first key success factor.

Conclusion

The products about which it is a question here are neither world “bestsellers” creating their own market (e.g. the iPhone), nor products supported by a very strong brand (e.g. the luxury sector), but rather products without emotional value which answer very practical expectations.

In these conditions, the deposits of growth shall be systematically and strictly exploited by developing and by spreading carefully local offers, each relevant on its segment.

Pagamon is a strategy and transformation consulting firm founded in 2013. We support major players in the industry, services and life sciences sectors in their search for balance. Helping them structure their strategic vision, transform their operational and/or digital model, and drive change. To support profitable, sustainable and responsible growth. As a committed player, Pagamon leads the Observatory of the Balanced Organization™, articulated around a “think tank” and an annual survey. In order to provide an innovative, sometimes offbeat, perspective on the strategic support of transformations to support the growth of companies.